A page of Cobical’s July 2020 Pride for its initial public offer (IPO), making some bold claims about the firm’s technology, which will later be included in the allegations of federal prosecutors.

Credit: seconds

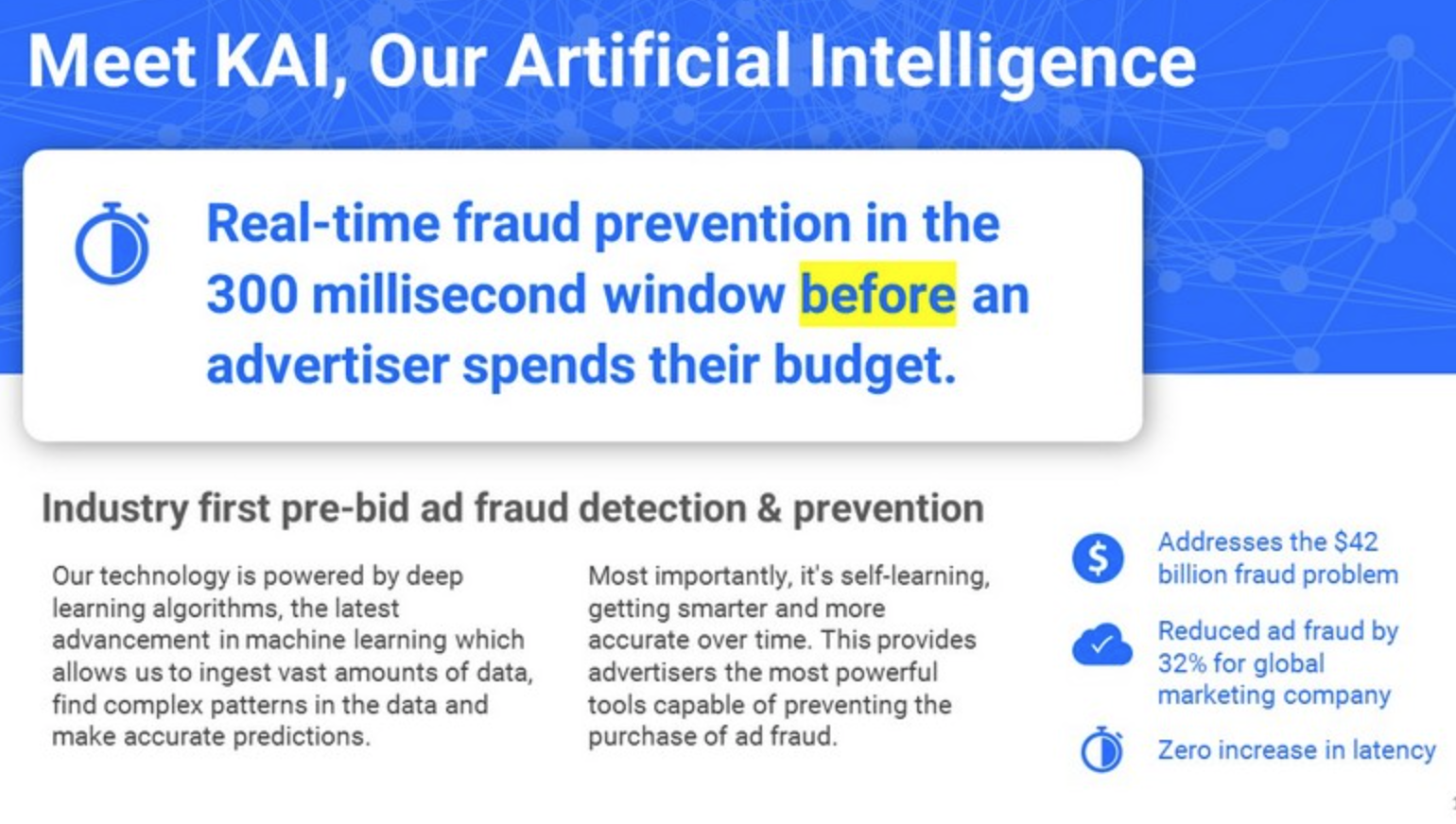

In August 2020, before the Cobayte’s IPO, Coben issued A prostitutes In 2019, advertising fraudulent billion 42 billion proposal suggesting research statistics. Cobayt’s technology was considered fast enough to operate in a 300 -second reel -time ads auction window. It took advantage of “machine learning driven” [sic] Pre -bidding advertising fraud technology “and” self -learning nerve networks always improve. “

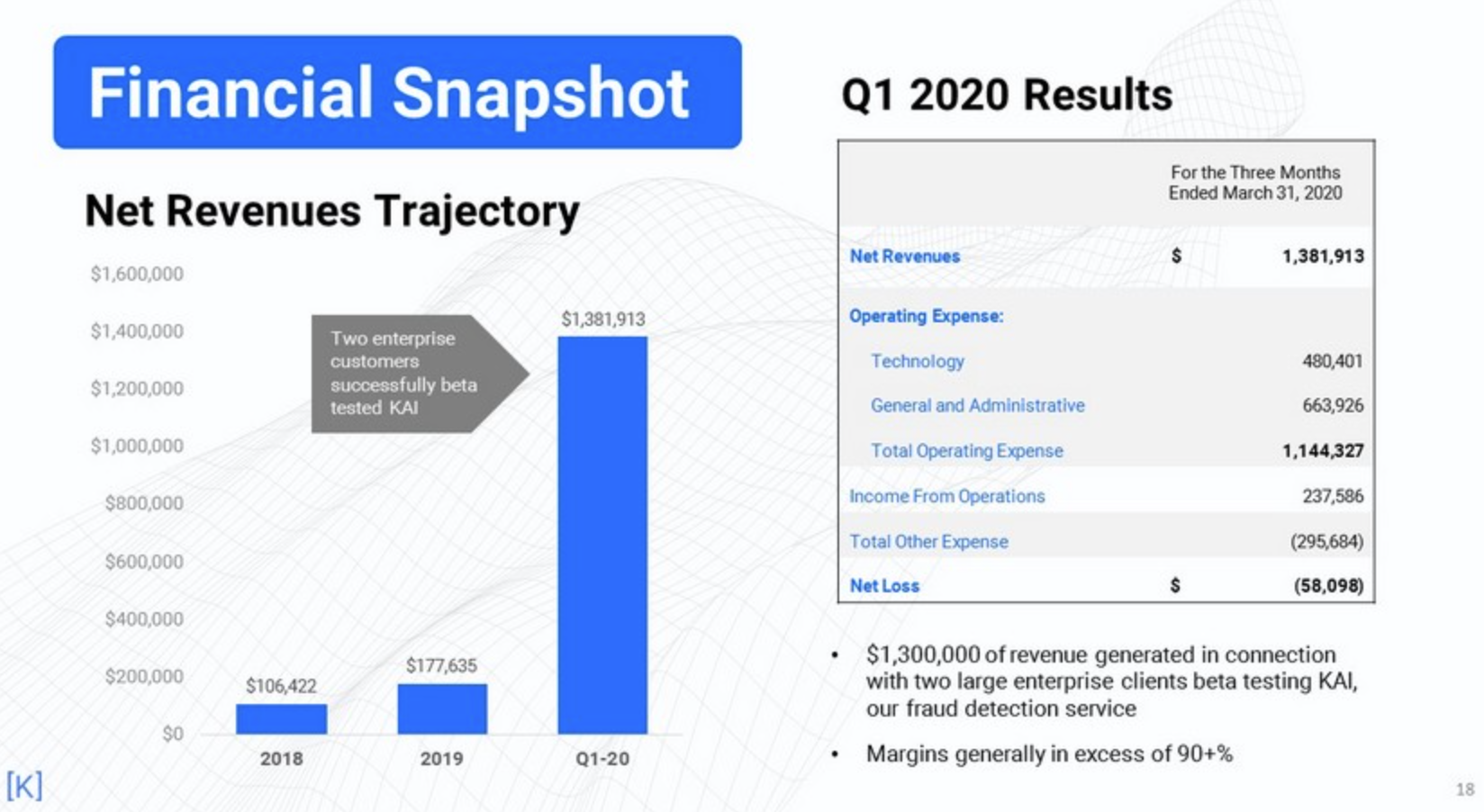

Thanks to “two enterprise users”, revenue for the first quarter of 2020 was shown as Q 1.38 million, which is a huge jump in Q1 2019 from $ 177,635. Prosecution Roberts was noted at the time of request It personally added the language that “about 300 300 % more digital ad is being identified and prevented” compared to partners of the current advertisement of the Cobayt client. Cobanet collected more than 33 million millions during his elementary and secondary equity offer.

The Securities and Exchange Commission, the US Postal Inspection Service, and the investigation of the US Attorney’s Office for the southern District New York, led to the allegations against Roberts in September 2024. Joshua A.V., a former Cobynt Chief Financial Officer, and a former chair of the former Audit Committee, were also charged with Green M. Quinn at the time.

Roberts, 48, suffered a 20 -year prisoner for the same charges of security by security. He will be subject to one year of supervision after his release after his term of service.

Kobent, which was told that Roberts was in the process of Percussion in Chapter 7 at the time of the plea of Roberts, Announced to be merged with Adumani And to name Adamani in May 2023.